Our Client

Our client is a U.S.-based AI company that provides advanced solutions to foster a fair financial system.

Using machine learning and extensive data, they aim to revolutionize traditional credit scoring and broaden the application of their unique fintech technology.

Their goal is to safely harness AI for credit underwriting. With their approach, lenders can optimize decisions, enhance loans, boost revenue, minimize risk, and streamline compliance. Our client is among the fastest-growing fintech firms.

NEEDS & REQUIREMENTS

Recognizing the need for expertise to rapidly scale up their teams, the customer set their sights on Data Scientists & ML Engineers from Poland—a recognized powerhouse in Data Science Outsourcing. They required specialists with strong Python skills who were knowledgeable in credit scoring and machine learning.

OUR APPROACH

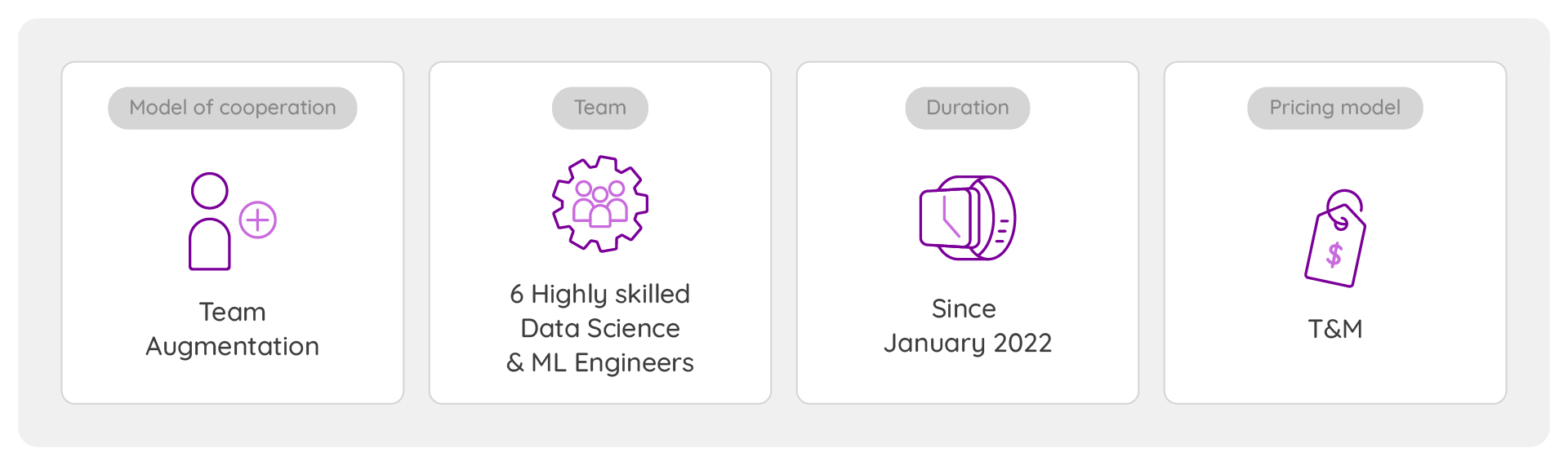

Algomine works with companies from the US and Europe, offering versatile collaboration models – from staff and team augmentation (ranging from individual specialists to a comprehensive team managed by the client), to a dedicated team managed by our Lead ML Engineer or Delivery Lead, supporting our customers during and after the project. Our pricing structure is flexible, based on the T&M model, and accommodates either monthly or hourly rates.

We deployed a remote team of 6 highly skilled Data Scientists & ML Engineers. These experts smoothly assimilated into the client’s operations, working closely with delivery managers to ensure timely product delivery.

The client set the priorities and managed the backlog. Algomine provided technological and project expertise and shared best practices drawn from years of experience

OUR SOLUTION

We utilized DataOps to build data processing pipelines and achieve continuous integration and employed DBT to craft complex processing logic. Our technical expertise featured Python (primarily using pandas, numpy, plotly, dash, and ML packages like Tensorflow, XGBoost, scikit-learn), Docker, Airflow, AWS S3, Git, and Github.

Some of our team’s tasks included:

- Updating numerous ML models to the latest Python versions.

- Automating model monitoring and performance analysis (with over 100 ML models implemented).

- Resolving bugs in the code that could have had a significant impact on production.

- Developing bias-free credit scoring models for all demographics.

- Developing tools to facilitate fair analysis, feature engineering, and model calibration.

THE RESULTS

Representing Poland’s hub of Data Science Outsourcing, Algomine delivered a team of proficient engineers that adeptly addressed the client’s diverse needs. As specialists in data science, we ensure that projects are executed efficiently, leveraging Poland’s top-tier tech expertise. Our successful collaboration solidified Algomine’s reputation as a trustworthy AI Staff Augmentation partner.